Energy crisis: What do you do if your energy supplier goes bust - and which companies have already folded?

More than a million people have now been affected by energy suppliers going bust after the price of buying gas on wholesale markets surged.

The rising costs are putting pressure on the suppliers - particularly smaller companies who are unable to pass on the increases to their customers - and households who face increased bills this winter.

Six firms already folded in September - PfP Energy, MoneyPlus Energy, Utility Point, People's Energy, Green, Avro Energy - and there are fears that more could follow, with Bulb and Igloo reportedly on the brink of collapse.

There are now roughly 40 suppliers in the UK market, sharply down from a peak of 70 in 2018.

Some of the UK's biggest energy companies could be offered state-backed loans in return for taking on customers from smaller suppliers.

However, Business Secretary Kwasi Kwarteng has repeatedly said he does not want to prop up companies that have been badly run, adding there is "no reward for failure".

Are you a customer of a small energy supplier and worried about keeping warm through the winter? Email us at news@sky.com

Below are answers to some of the key questions coming out of the crisis:

What if your supplier goes bust?

If a supplier fails, Ofgem - the UK's independent energy regulator - will ensure customers' gas and electricity supply continues uninterrupted.

Customers will be switched to a "supplier of last resort" and any credit with the old supplier will be transferred.

If a supplier of last resort is not possible, a special administrator would be appointed by Ofgem and the government.

Your old tariff will end and the new supplier will put you on a special "deemed" contract, which will last for as long as you want it to.

The deemed contract could cost you more, as the new supplier takes on more risk (for example, possibly having to buy extra wholesale energy at short notice to supply to the new customers), but Ofgem says it will try to get the best deal for you.

Boris Johnson has pledged

his government will 'do everything we can' to prevent energy companies

going under as wholesale gas prices surge in the UK. File pic

Boris Johnson has pledged

his government will 'do everything we can' to prevent energy companies

going under as wholesale gas prices surge in the UK. File pic

You should take meter readings as you will need to pass these on to your new supplier.

Once your new supplier has been in touch, ask them to put you on their cheapest deal. Then shop around and switch if you want to. You won't be charged exit fees.

Why have gas prices risen so dramatically?

As in any market, the whole price of gas can go up and down - and costs typically do rise at this time of year, with an increased demand for heating and people switching on lights earlier in the day.

However, this year it coincides with the economy opening up from pandemic lows, so demand is even higher.

A perfect storm of other problems has also hit the sector: supply from Russia has dried up recently, demand is high in Asia and in the UK several gas platforms in the North Sea have closed to perform maintenance that was paused during the pandemic.

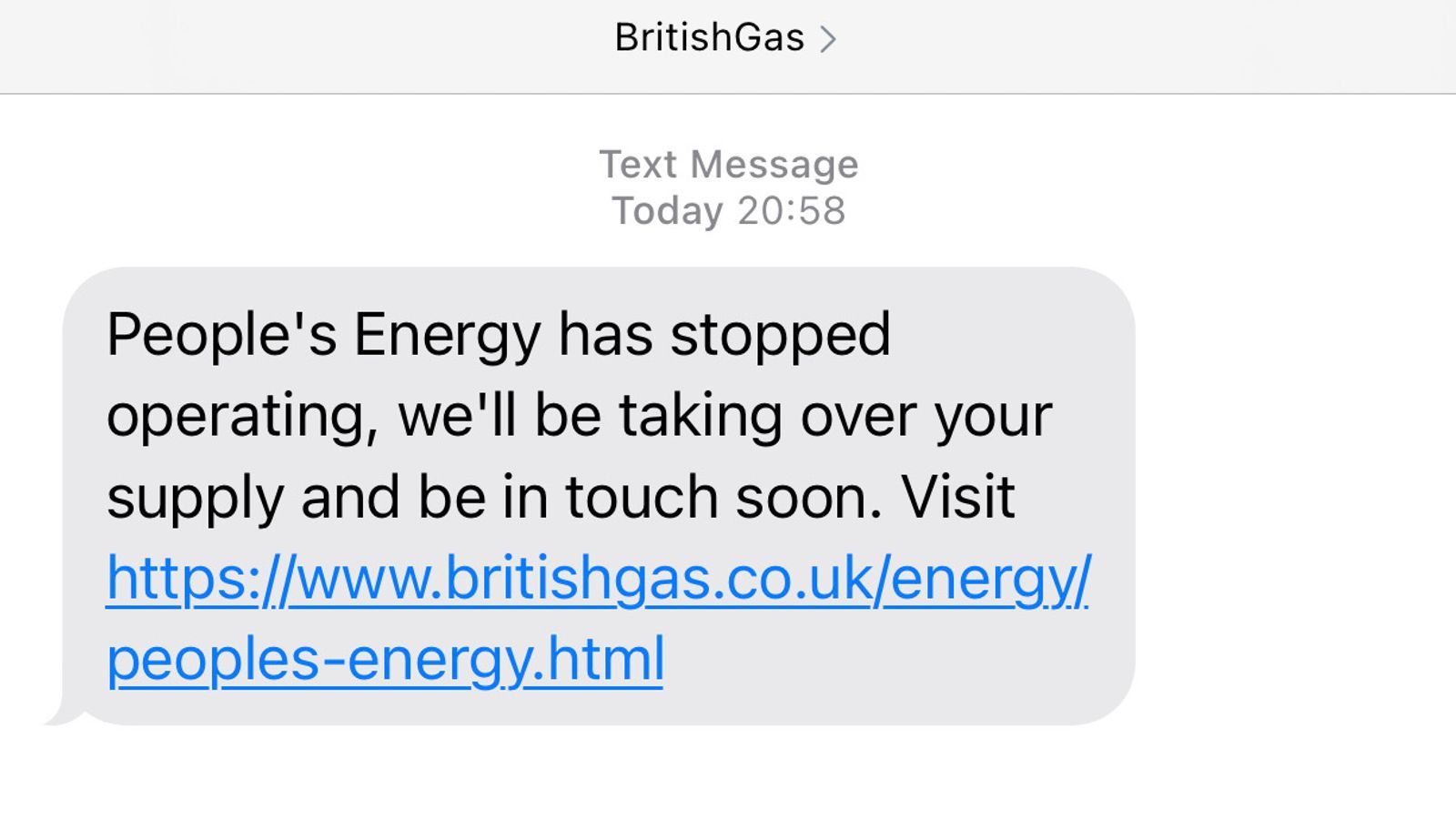

British Gas stepped in to operate People's Energy's supply after the company folded last week.

British Gas stepped in to operate People's Energy's supply after the company folded last week.

Will my energy bill rise?

It depends on what kind of deal you are on.

If you are on a fixed-price tariff, it means the price you pay is fixed for the length of your contract, so you won't be affected - but you will probably have to switch to a more expensive deal when your contract comes to an end.

If you are on a flexible tariff, this changes in line with wholesale prices.

The rise announced late last year, which came into effect in October, means that nobody covered by the price cap will see their bills rise by more than 12% before the next review, which is due to take place in April.

Ofgem has said consumers can expect an average price rise of £135 this winter.

Why are energy suppliers going bust?

Many smaller suppliers promised to sell gas to customers for less than it is now costing them to buy.

When people sign a fixed-term deal, the energy suppliers expect the price of gas to go up and down, which gives them some room for price changes.

But the unprecedented rise in global prices means a lot of customers are now paying less for energy than costs the supplier to buy, which is not a viable business strategy.

What is hedging and why have so many energy suppliers not done it?

The energy suppliers that stay afloat are likely to be those that have hedged - a type of insurance which steps in if prices rise too much.

But like all insurance, hedging costs money. So many suppliers - who are living on razor-thin margins anyway - decide not to and are now paying the price.

Some analysts fear the UK's energy companies could be drastically reduced over the coming months. File pic

Some analysts fear the UK's energy companies could be drastically reduced over the coming months. File pic

How long could this last?

Europe's winter heating season typically begins in October and wholesale prices are not forecast to fall significantly during the remainder of this year.