Moody's Downgrades U.S. Credit Outlook to Negative Amid Fiscal Concerns

Moody's has changed its view on the U.S. credit rating to negative, stressing concerns over high fiscal deficits and reduced debt affordability, provoking disapproval from the Biden administration. This revision came after Fitch downgraded the U.S. earlier in the year following prolonged political clashes over the debt ceiling.

Market apprehensions have grown due to federal expenditure and political divisions, pushing government bond prices to a 16-year low.

"With little hope for fiscal consolidation, deficits and debt are expected to grow," said Christopher Hodge of Natixis.

The agency warns of the obstacles posed by political divisions in Congress to agree on a fiscal strategy that could stabilize the downturn in debt affordability.

Moody's expects significant policy actions are unlikely before 2025 due to the political schedule.

As Republicans plan a stopgap bill to avoid a government shutdown, Moody's still affirms the U.S.' 'Aaa' ratings based on credit and economic strengths.

However, the negative outlook suggests a potential downgrade in the future.

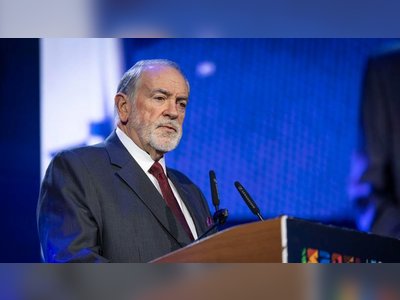

The White House and Deputy Treasury Secretary Wally Adeyemo defended the robustness of the U.S. economy and disagreed with the negative shift while touting deficit reduction efforts.

Treasury yields have risen sharply due to anticipation of a tight monetary policy and fiscal worries, placing further strain on debt affordability.

While a Moody's downgrade could heighten fiscal concerns, the actual impact on the bond market, a recognized safe haven, may be limited.

This Moody's announcement comes as President Biden, who aims for re-election in 2024, faces declining popularity in key battleground states, and it puts additional pressure on congressional Republicans to pass funding legislation to prevent a partial government shutdown.

House Speaker Mike Johnson criticizes Biden's spending policies and vows to correct the nation's finances amid internal Republican disagreements and both parties' roles in increasing deficits.

The House and Senate must concur on a spending bill by November 17 to circumvent a funding lapse.

Neither party has yet addressed the growing costs of key federal programs like Social Security and Medicare, which contribute to the deficit.

"With little hope for fiscal consolidation, deficits and debt are expected to grow," said Christopher Hodge of Natixis.

The agency warns of the obstacles posed by political divisions in Congress to agree on a fiscal strategy that could stabilize the downturn in debt affordability.

Moody's expects significant policy actions are unlikely before 2025 due to the political schedule.

As Republicans plan a stopgap bill to avoid a government shutdown, Moody's still affirms the U.S.' 'Aaa' ratings based on credit and economic strengths.

However, the negative outlook suggests a potential downgrade in the future.

The White House and Deputy Treasury Secretary Wally Adeyemo defended the robustness of the U.S. economy and disagreed with the negative shift while touting deficit reduction efforts.

Treasury yields have risen sharply due to anticipation of a tight monetary policy and fiscal worries, placing further strain on debt affordability.

While a Moody's downgrade could heighten fiscal concerns, the actual impact on the bond market, a recognized safe haven, may be limited.

This Moody's announcement comes as President Biden, who aims for re-election in 2024, faces declining popularity in key battleground states, and it puts additional pressure on congressional Republicans to pass funding legislation to prevent a partial government shutdown.

House Speaker Mike Johnson criticizes Biden's spending policies and vows to correct the nation's finances amid internal Republican disagreements and both parties' roles in increasing deficits.

The House and Senate must concur on a spending bill by November 17 to circumvent a funding lapse.

Neither party has yet addressed the growing costs of key federal programs like Social Security and Medicare, which contribute to the deficit.

Translation:

Translated by AI