Banking system on the verge of a 'Bear Stearns moment': Former FDIC chair

Bear Stearns was one of the first banks to collapse during the 2008 mortgage crisis

While some observers fear federal officials' actions following the collapse of Silicon Valley Bank and Signature Bank will fuel a"moral hazard," one former Federal Deposit Insurance Corporation chair cautions the U.S. banking system is nearing another "Bear Stearns moment."

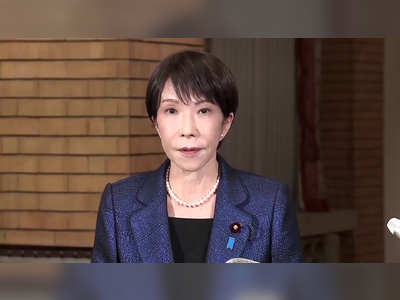

"I think this is more of a Bear Stearns moment. I think a lot of people, including me, said when they bailed out Bear Stearns, they increased moral hazard. They created an expectation of further bailouts," former FDIC Chair Sheila Bair said Friday on "Cavuto: Coast to Coast" Friday.

The Treasury Department, Federal Reserve, and the FDIC said in a joint statement Sunday that they were taking "decisive actions to protect the U.S. economy by strengthening public confidence in our banking system" following the implosion of SVB. Depositors of the SVB would have access to all of their money

Bear Stearns collapsed during the mortgage crisis in 2008. Leading to a larger industry and market crash, Bear Stearns' risky investment strategies had more detrimental consequences than expected. Six months later, Lehman Brothers failed, and Merrill Lynch was forced to merge with Bank of America.

Bear Stearns avoided bankruptcy by its sale to JPMorgan at a 93 percent discount for $2 per share, but eventually agreed to $10 per share. The sale was also supported by the government, and its involvement sent an unprecedented message that the government would help bail out banks.

"There's no doubt in my mind Lehman Brothers would have solved its own problems earlier on," Bair explained. "It would have sold itself, raised more capital, all the above, if they hadn't thought in the back of their minds, 'They wouldn't dare not bail us out. We're bigger than Bear Stearns.' That's the problem. That's the expectation that you create. Then you don't do a bailout, and…you really have the system seizing up, as we saw when Lehman Brothers went into bankruptcy."

As the markets respond to the bailout of SVB and Signature Bank as well as the rescue of First Republic, Bair noted that fear is starting to mount for the banking system and uncertainty is spreading.

"Fear is sitting in; fear, not rationality. And I think the problem was that they did bailouts of these two mid-sized banks, very tiny parts of the overall system, in the name of systemic risk, and that created a lot of uncertainty," she said.

Bair added that the "immediate problem" posed by the situation in the banking system is "if people start to panic and take deposits out of a perfectly healthy bank, they're going to force that bank to close."

"It's the classic Jimmy Stewart problem," she told host Neil Cavuto. "We deposit money into a bank, they lend it out, they invest it in securities, it's not all sitting in a vault. If you try to get all the money out at once, you're going to force the bank to unnecessarily fail."

According to Bair, actions taken by the government have created "mass confusion" that could cause efforts to support the banking system to backfire. Acknowledging there are some banks with problems, she also emphasized that only a small percentage of the overall banking system has issues.

"[The government is] trying to imply that all uninsured are protected, which they don't have legal authority to do, frankly, and this is putting pressure on community banks," she said. "It's really troubling."

As the former head of the FDIC, Bair shared her thoughts on what the right course of action would have been to handle the SVB and Signature Bank collapse.

"I think the better way to communicate would have been to handle these two bank failures with the regular FDIC process, which would have involved the uninsured depositors getting sizable dividends this week," she said. "Remind people there are deposit insurance limits, remind people that some banks can and do fail. They need to be vigilant and leave it at that."

Since the SVB and Signature Bank bailout, First Republic was hit with collateral damage from the collapse. Customers yanked billions in deposits out of First Republic, prompting the bank to shore up its finances with additional funding from the Fed and JPMorgan. That first cash infusion gave the bank — which boasts $213 billion in assets — roughly $70 billion in unused liquidity.

On Thursday afternoon, major banks swooped in to provide a $30 billion deposit to First Republic amid fears of a larger financial crisis.

JPMorgan Chase, Citigroup, Bank of America and Wells Fargo will each contribute $5 billion; Goldman Sachs and Morgan Stanley will deposit about $2.5 billion each, according to a news release from the banks. Truist, PNC, U.S. Bancorp, State Street and Bank of New York Mellon will provide about $1 billion apiece.

With a delicate banking system, Bair warned the government may need to temporarily continue bailouts to ensure market activity doesn't cause additional banks to fall like dominoes.

"As much as I hate to say it, [the government] may need to do more bailouts, not less through the system. If it's systemic, then provide a blanket guarantee temporarily."

"I think this is more of a Bear Stearns moment. I think a lot of people, including me, said when they bailed out Bear Stearns, they increased moral hazard. They created an expectation of further bailouts," former FDIC Chair Sheila Bair said Friday on "Cavuto: Coast to Coast" Friday.

The Treasury Department, Federal Reserve, and the FDIC said in a joint statement Sunday that they were taking "decisive actions to protect the U.S. economy by strengthening public confidence in our banking system" following the implosion of SVB. Depositors of the SVB would have access to all of their money

Bear Stearns collapsed during the mortgage crisis in 2008. Leading to a larger industry and market crash, Bear Stearns' risky investment strategies had more detrimental consequences than expected. Six months later, Lehman Brothers failed, and Merrill Lynch was forced to merge with Bank of America.

Bear Stearns avoided bankruptcy by its sale to JPMorgan at a 93 percent discount for $2 per share, but eventually agreed to $10 per share. The sale was also supported by the government, and its involvement sent an unprecedented message that the government would help bail out banks.

"There's no doubt in my mind Lehman Brothers would have solved its own problems earlier on," Bair explained. "It would have sold itself, raised more capital, all the above, if they hadn't thought in the back of their minds, 'They wouldn't dare not bail us out. We're bigger than Bear Stearns.' That's the problem. That's the expectation that you create. Then you don't do a bailout, and…you really have the system seizing up, as we saw when Lehman Brothers went into bankruptcy."

As the markets respond to the bailout of SVB and Signature Bank as well as the rescue of First Republic, Bair noted that fear is starting to mount for the banking system and uncertainty is spreading.

"Fear is sitting in; fear, not rationality. And I think the problem was that they did bailouts of these two mid-sized banks, very tiny parts of the overall system, in the name of systemic risk, and that created a lot of uncertainty," she said.

Bair added that the "immediate problem" posed by the situation in the banking system is "if people start to panic and take deposits out of a perfectly healthy bank, they're going to force that bank to close."

"It's the classic Jimmy Stewart problem," she told host Neil Cavuto. "We deposit money into a bank, they lend it out, they invest it in securities, it's not all sitting in a vault. If you try to get all the money out at once, you're going to force the bank to unnecessarily fail."

According to Bair, actions taken by the government have created "mass confusion" that could cause efforts to support the banking system to backfire. Acknowledging there are some banks with problems, she also emphasized that only a small percentage of the overall banking system has issues.

"[The government is] trying to imply that all uninsured are protected, which they don't have legal authority to do, frankly, and this is putting pressure on community banks," she said. "It's really troubling."

As the former head of the FDIC, Bair shared her thoughts on what the right course of action would have been to handle the SVB and Signature Bank collapse.

"I think the better way to communicate would have been to handle these two bank failures with the regular FDIC process, which would have involved the uninsured depositors getting sizable dividends this week," she said. "Remind people there are deposit insurance limits, remind people that some banks can and do fail. They need to be vigilant and leave it at that."

Since the SVB and Signature Bank bailout, First Republic was hit with collateral damage from the collapse. Customers yanked billions in deposits out of First Republic, prompting the bank to shore up its finances with additional funding from the Fed and JPMorgan. That first cash infusion gave the bank — which boasts $213 billion in assets — roughly $70 billion in unused liquidity.

On Thursday afternoon, major banks swooped in to provide a $30 billion deposit to First Republic amid fears of a larger financial crisis.

JPMorgan Chase, Citigroup, Bank of America and Wells Fargo will each contribute $5 billion; Goldman Sachs and Morgan Stanley will deposit about $2.5 billion each, according to a news release from the banks. Truist, PNC, U.S. Bancorp, State Street and Bank of New York Mellon will provide about $1 billion apiece.

With a delicate banking system, Bair warned the government may need to temporarily continue bailouts to ensure market activity doesn't cause additional banks to fall like dominoes.

"As much as I hate to say it, [the government] may need to do more bailouts, not less through the system. If it's systemic, then provide a blanket guarantee temporarily."

Comments

Oh ya 3 year ago

The government screwed up when they changed the Glass Steagall Act. They need to get back in place.. But the government does everything for their friends in big money and to hell with the common person