Kuwait equities attractively priced as country embarks on structural changes, awaits MSCI reclassification

This is the view of the KMEFIC FTSE Kuwait Equity UCITS ETF (KUW8), a UCITS compliant Exchange Traded Fund domiciled in Ireland which tracks the FTSE Kuwait All Cap 15% Capped Index, an index of large, mid and small cap securities trading on the premier or main market of Kuwait Stock Exchange.

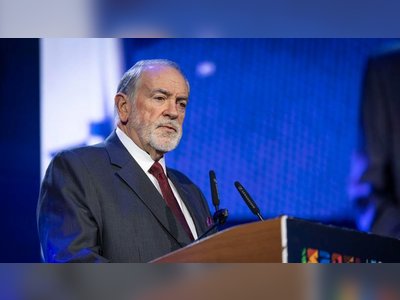

Abdullah Al-Busairi, director of KMEFIC FTSE Kuwait ETF, commented: “The postponement of MSCI’s upgrade for Kuwait to emerging market status was a blessing in disguise as it has allowed Kuwaiti firms time to stabilize prior to the inclusion of major new investor inflows.

“This, combined with the fact that Kuwait has seemingly been successful so far in controlling the pandemic and is now slowly opening the economy back up, means Kuwait equity prices are very competitively priced. Even so, buying pressure will slowly ramp up again prior to the emerging market status upgrade in November.”

As for the broader economic outlook, in addition to the country’s efforts to boost its non-oil economy through its vision 2035 plan, the KUW8 Kuwait ETF spokesperson says several other factors support a more positive outlook for Kuwait. These include:

Budget Reform

While budget reform has been a constant talking point in Kuwait for several years, it has never been spoken about with urgency, and limited action has been taken.

However, there have now been some budget cuts across the board to several government institutions, as well as a growing effort to reduce the workforce, which accounts for a large part of government spending because over 70% of it is employed in the public sector.

These cuts will force many institutions to run more efficiently. In addition, there has been an active effort to finally implement a government taxation plan in the form of VAT on specific goods.

Finally, parliamentary debate regarding the public debt law which would allow the Kuwait government to borrow up to $65 billion from local and international sources over the next 30 years has reached critical phases with the finance minister pushing hard for parliament to approve and pass the law.

Anti-Corruption

In light of two large recent corruption scandals in the country, the government seems to have re-doubled its efforts to fight corruption, an effort, which has been gaining a lot of momentum in the past two to three years with several high-profile cases identified and investigated. Anti-money laundering efforts have also been gaining momentum as well.

Stimulus Plan

There has been talk of a stimulus plan, the first of which saw government support for the private sector to prevent the collapse of the non-oil sector due to COVID-19.

Investing in Kuwait

The KMEFIC FTSE Kuwait Equity UCITS ETF (KUW8) was the first UCITS ETF to provide targeted exposure to Kuwaiti securities. It is also the only UCITS ETF to be sponsored by a Kuwait asset manager, (Kuwait & Middle East Financial Investment Company).

Priced at 80bps, KUW8 includes 17 of the largest and most liquid securities trading on Borsa Kuwait and uniquely is focused away from the declining energy sector and towards sectors that stand to benefit most from ‘Vision 2030’ spending.

As such, KUW8 offers investors an efficient, liquid and diversified tool for investors who want to benefit from the potential impact of the upgrade.