Saudi market withstands global headwinds, braces for 2023

With the highest growth rate among the G20 countries, continuous efforts to diversify the economy and a healthy inflow of foreign direct investment, Saudi Arabia’s market performance has been resilient.

“Tadawul is by far the largest stock exchange in the Middle East, and it is seeking to become a regional center with cross-listings of companies from other countries in the Gulf,” said Waleed Rasromani, corporate mergers and acquisitions partner of Dubai and Riyadh at Linklaters, a UK-based multinational law firm.

Intense merger and acquisition activity combined with significant growth in initial public offerings have led the Kingdom’s market to evolve and is expected to carry that momentum into 2023.

Geared for market growth

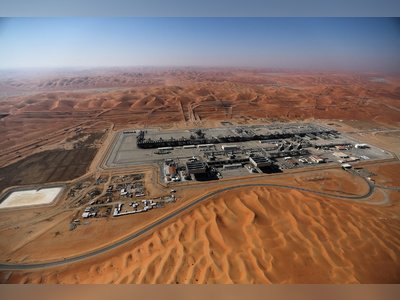

The Kingdom’s oil-led growth, non-oil diversification strategy and governmental frameworks created a strong foundation for its impressive market performance.

Strong liquidity, local investor appetite for Saudi stocks and the pursuit of goals outlined in Vision 2030 have also facilitated the market’s development.

“The IPO market in the Kingdom is expected to remain resilient, and we

anticipate increased IPO traction. It doesn’t seem like there would be a

slowdown there,” Ali Anwar, Managing director and the Middle East

practice leader with Alvarez & Marsal Global Transaction Advisory

Group in Dubai

“The IPO market in the Kingdom is expected to remain resilient, and we

anticipate increased IPO traction. It doesn’t seem like there would be a

slowdown there,” Ali Anwar, Managing director and the Middle East

practice leader with Alvarez & Marsal Global Transaction Advisory

Group in Dubai

The International Monetary Fund also noted that Saudi Arabia would maintain its position as the fastest-growing economy among the G20 countries despite economic headwinds.

As for legislative efforts, the Capital Market Authority is working toward making the financial market more attractive and transparent and raising investors’ awareness.

CMA is focused on raising institutional investor turnover to 41 percent of the total market turnover by the financial year of 2023.

The Kingdom’s Financial Sector Development Program is another factor that enables and supports Saudi market growth.

Excluding the Saudi Arabian Oil Co. IPO, it aimed to increase the value of the stock market as a percentage of the gross domestic product to 88 percent by 2030 from 66.5 percent in 2019. Saudi Aramco closing share price on Dec. 29 at SR32.10.

Saudi governmental authorities are also stimulating the planned privatization of state-owned institutions through IPOs on the Saudi stock exchange.

In addition, Saudi firms prefer to list IPOs locally rather than on more developed stock exchanges, probably due to disclosure and corporate governance requirements.

“The Saudi government’s push for privatization has prompted more IPOs, and the involvement of key sovereign funds and stakeholders in the capital markets is helping the Kingdom monetize its investments,” said Ibrahim Soumrany, a partner at US-based global law firm White & Case in Dubai.

Soumrany added that more foreign companies are considering listing in the Kingdom. As a result, there is increasing support to permit dual listings in the coming years as more companies seek to list both in their local markets and Saudi Arabia.

Robust performance

The Kingdom was the best performing of all the emerging markets since COVID-19, with the market capitalization of Tadawul up 24 percent year on year to reach $3.19 trillion in the first quarter of 2022. The market capitalization on Dec.29 was nearly $2.63 trillion.

As of December, the earnings for Saudi-listed companies have grown 22 percent per year over the last three years. In addition, their revenues increased by 19 percent per year, indicating that these firms are generating more sales and their profits are on the rise.

Nevertheless, the owner of the Kingdom’s bourse recently recorded a 23 percent decrease in profit to SR367 million ($98 million) in the first nine months of 2022.

This dip was coupled with a 7 percent decline in revenue to SR849 million, mainly due to the decrease in trading and post-trade services.

Higher salaries and employee-related benefits further weighed on profit between January and September, leading to a 14.7 percent year-on-year increase in operating expenses to SR465 million.

At the start of December, the Kingdom’s stock market benchmark index fell 2.5 percent to hit its lowest since April last, pulled down by a 4.9 percent and 4.7 percent dip in Al-Rajhi Bank and Riyadh Bank, respectively.

Why? Since the Saudi riyal is pegged to the US dollar and the Saudi Central Bank follows the US Federal Reserve’s open market operations, the Kingdom takes a hit when the Fed pursues quantitative tightening to reign over inflation.

“Tadawul is by far the largest stock exchange in the Middle East, and it

is seeking to become a regional center with cross-listings of companies

from other countries in the Gulf,” said Waleed Rasromani, Corporate

mergers and acquisitions partner of Dubai and Riyadh at Linklaters.

“Tadawul is by far the largest stock exchange in the Middle East, and it

is seeking to become a regional center with cross-listings of companies

from other countries in the Gulf,” said Waleed Rasromani, Corporate

mergers and acquisitions partner of Dubai and Riyadh at Linklaters.

“However, the market could find some support in solid local fundamentals,” Daniel Takieddine, CEO of the Middle East and North Africa region of Seychelles-based financial institution BDSwiss.

Al-Rajhi Bank and Riyadh Bank share prices closed on Dec.29 at SR75.20 and SR31.80, respectively.

Gulf markets have witnessed a banner year with regard to IPOs, benefiting from a war-driven surge in oil prices, with Saudi Arabia at the forefront.

The Kingdom is also leading the way in regional listing activity despite the fall in IPOs in developed markets due to global uncertainties and stock market volatility.

“The IPO market in the Kingdom is expected to remain resilient, and we anticipate increased IPO traction. It doesn’t seem like there would be a slowdown there,” noted Ali Anwar, managing director and the Middle East practice leader with Alvarez & Marsal Global Transaction Advisory Group in Dubai.

Saudi Arabia had two IPOs on Tadawul and three on its parallel market Nomu during the third quarter of this year, making $490 million in total proceeds, according to leading professional services firm Ernst & Young.

As for early next year, the Saudi market is expected to see growth in M&A activity propped up by rising corporate enthusiasm to maximize shareholder wealth through strategic partnerships and business alliances, according to a press release by Riyadh-based GIB Capital.

“We are seeing a fundamental maturity in the attitude of the Saudi corporate community toward business combinations and partnerships, which is very promising for our market,” said Khalid AlGhamdi, the acting CEO of GIB Capital.

Anwar further highlighted that despite the possibility of a dip in 2023 compared to the previous year, Saudi Arabia will retain large financial buffers and push ahead with ambitious investment programs in line with Vision 2030.

Future outlook

When asked about the outlook for 2023, Anwar told Arab News: “The Kingdom of Saudi Arabia is brimming with confidence.” On the other hand, Rasromani of Linklaters said, “I am optimistic for the coming year.”

This sentiment is evident in the Riyadh-based brokerage Al Rajhi Capital’s 2023 outlook report.

A survey from the report showed that approximately 60 percent of participants expect the markets to be in the positive range, 23 percent of which expect gains to surpass 5 percent, despite the economic uncertainty and fears of recession.

The report identified the banking sector as the most preferred, where participants anticipate net interest margin expansion and growth in corporate loans to drive the profitability of banks during the fourth quarter of 2022 and the following one.

The petrochemicals sector unexpectedly topped the list of the most appealing industries as the prices weakened in the past on demand concerns due to global instability.

“I expect that the industrial sector will be active in the Kingdom as the drive to localize supply chains continues, and renewable energy will also likely be of key interest as numerous projects are launched,” noted Rasromani.

He added, “I am most excited about venture capital because this form of investing has become increasingly sophisticated in the Kingdom, and it has the potential to transform society and business for the better fundamentally.”