How Saudi Crown Prince's Plan Will Impact Nation's Economy

Saudi Arabia's latest economic plan comes with a big risk: while it might help boost investment, it could also hit the government's finances.

Crown Prince Mohammed bin Salman wants the kingdom's biggest companies -- including oil giant Saudi Aramco and chemical maker Sabic -- to reduce their dividends, most of which are paid to the state, and spend the money locally.

The idea is that their expenditure on new infrastructure and technology will be big enough to accelerate the country's growth and cause a jobs boom.

The de facto leader's strategy amounts to a "sacrificing of current profits for future investments," Karen Young, resident scholar at the American Enterprise Institute in Washington, said in an opinion piece. "There is a generational shift: a moment to build and create a post-oil era, but in the short-term, the government will be exhausting its resources."

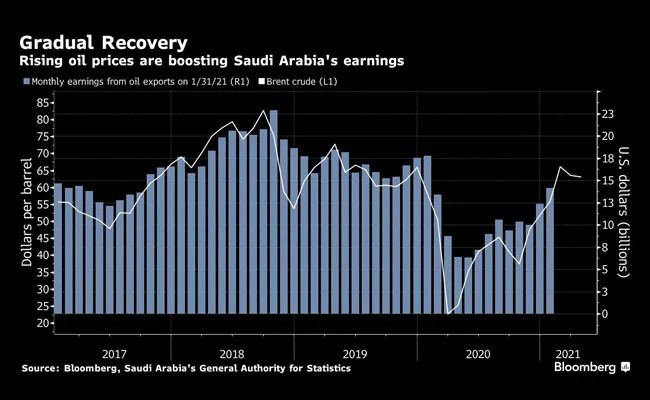

Here's a look at the likely impact on the budget and the economy, which was hit hard last year by the coronavirus pandemic and crash in oil prices.

Oil Money:

Aramco, the world's largest oil company, transferred $110 billion to the government in 2020 through shareholder payouts, royalties and income tax, a 30% drop from the previous year.

Lower dividends from the firm, 98% state-owned, would "weigh on the government's revenues," according to James Swanston of Capital Economics.

He's unconvinced the extra investment in the economy would lead to a substantial boost in the government's tax take from other industries, at least in the short term.

Still, Aramco has said it can sustain its dividend, which was the world's biggest last year at $75 billion. It's been helped by Brent crude's rise of almost 30% since December to $67 a barrel as more nations emerge from lockdowns. And last week the firm announced a deal that will see a U.S.-led consortium invest $12.4 billion in its pipelines.

A stronger balance sheet and higher cash flow may enable it both to keep the dividend and invest more locally.

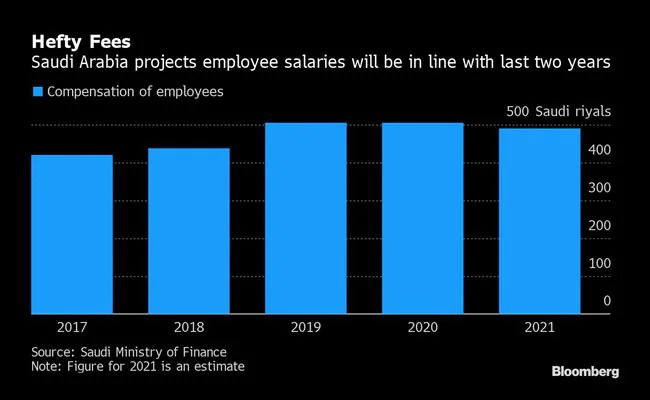

Wages and Settlements:

Wages and pensions for state workers are expected to reach 491 billion riyals ($131 billion) this year, accounting for almost half of total spending of 990 billion riyals. Yet if oil prices stay above $60, Saudi Arabia might be able to cover salaries from crude sales alone, according to Ziad Daoud, chief emerging markets economist for Bloomberg Economics.

Whether that happens is a crucial part of the 35-year-old Prince Mohammed's initiative. The country managed to raise non-oil revenue from 166 billion riyals in 2015 to 358 billion riyals in 2020.

But there's a catch. Much of the improvement was down to settlements with some of the kingdom's richest people that began in 2017 with what were known as the Ritz-Carlton arrests, part of the prince's anti-corruption drive.

"Growth in Saudi Arabia's non-oil revenue is only partially organic," said Daoud. The agreements "account for a fifth of non-oil revenue. These settlements will conclude at some point. When they do, not only will non-oil revenue cease to rise, it'll actually fall. To achieve sustainable growth, the kingdom must raise productivity and increase non-oil exports."

Sovereign Fund:

If the budget -- the deficit of which reached 12% of gross domestic product last year -- is stretched due to lower payouts from Saudi companies, the $400 billion sovereign wealth fund may be able to pick up the slack.

The Public Investment Fund is already positioning itself to drive the local economy. Prince Mohammed has pledged it will spend at least $40 billion a year at home through 2025, creating new cities, resorts and 1.8 million jobs.

"The budget is increasingly focused on managing the government's day-to-day expenses rather than being an engine of economic growth," said Mohamed Abu Basha, head of macroeconomic research at Cairo-based investment bank EFG-Hermes Holding. Capital expenditure "is predominantly shifting to PIF and sister state institutions."

Lasting Impact:

In December, the government projected revenue of 849 billion riyals for 2021 and a fiscal deficit of 4.9% of GDP.

Back then, oil was trading at barely $50 a barrel. It's now risen to a point at which Saudi Arabia can balance its budget, the International Monetary Fund estimates.

Yet the lasting impact of the pandemic on Saudi businesses and global energy demand mean the kingdom's finances are still precarious, according to Abu Basha.

"The boost to future non-oil revenues will depend going forward on the dividends from all these state-owned investments," said Abu Basha. "This further increases fiscal vulnerability."