Why everyone thinks a recession is coming in 2023

Recessions often take everyone by surprise. There’s a very good chance the next one will not.

Economists have been forecasting a recession for months now, and most see it starting early next year. Whether it’s deep or shallow, long or short, is up for debate, but the idea that the economy is going into a period of contraction is pretty much the consensus view among economists.

“Historically, when you have high inflation, and the Fed is jacking up interest rates to quell inflation, that results in a downturn or recession,” said Mark Zandi, chief economist at Moody’s Analytics. “That invariably happens — the classic overheating scenario that leads to a recession. We’ve seen this story before. When inflation picks up and the Fed responds by pushing up interest rates, the economy ultimately caves under the weight of higher interest rates.”

Zandi is in the minority of economists who believe the Federal Reserve can avoid a recession by raising rates just long enough to avoid squashing growth. But he said expectations are high that the economy will swoon.

“Usually recessions sneak up on us. CEOs never talk about recessions,” said Zandi. “Now it seems CEOs are falling over themselves to say we’re falling into a recession. ... Every person on TV says recession. Every economist says recession. I’ve never seen anything like it.”

Fed causing it this time

Ironically, the Fed is slowing the economy, after it came to the rescue in the last two economic downturns. The central bank helped stimulate lending by taking interest rates to zero, and boosted market liquidity by adding trillions of dollars in assets to its balance sheet. It is now unwinding that balance sheet, and has rapidly raised interest rates from zero in March — to a range of 4.25% to 4.5% this month.

But in those last two recessions, policymakers did not need to worry about high inflation biting into consumer or corporate spending power, and creeping across the economy through the supply chain and rising wages.

The Fed now has a serious battle with inflation. It forecasts additional rate hikes, up to about 5.1% by early next year, and economists expect it may maintain those high rates to control inflation.

Those higher rates are already taking a toll on the housing market, with home sales down 35.4% from last year in November, the 10th month in a row of decline. The 30-year mortgage rate is close to 7%. And consumer inflation was still running at a hot 7.1% annual rate in November.

“You have to blow the dust off your economics textbook. This is going to be be a classic recession,” said Tom Simons, money market economist at Jefferies. “The transmission mechanism we’re going to see it work through first in the beginning of next year, we’ll start to see some significant margin compression in corporate profits. Once that starts to take hold, they’re going to take steps to cut their expenses. The first place we’re going to see it is in reducing headcount. We’ll see that by the middle of next year, and that’s when we’ll see economic growth slowdown significantly and inflation will come down as well.”

How bad will it be?

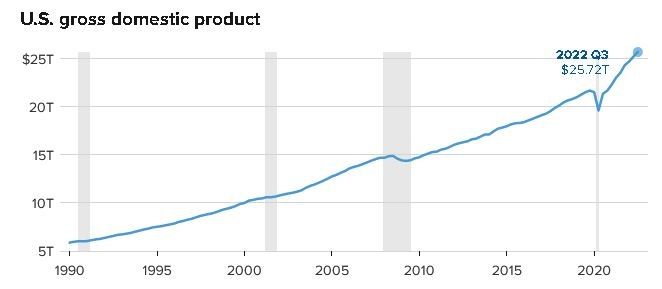

A recession is considered to be a prolonged economic downturn that broadly affects the economy and typically lasts two quarters or more. The National Bureau of Economic Research, the arbiter of recessions, considers how deep the slowdown is, how wide spread it is and how long it lasts.

However, if any factor is severe enough, the NBER could declare a recession. For instance, the pandemic downturn in 2020 was so sudden and sharp with wide-reaching impact that it was determined to be a recession even though it was very short.

“I’m hoping for a short, shallow one, but hope springs eternal,” said Diane Swonk, chief economist at KPMG. “The good news is we should be able to recover from it quickly. We do have good balance sheets, and you could get a response to lower rates once the Fed starts easing. Fed-induced recessions are not balance sheet recessions.”

The Federal Reserve’s latest economic projections show the economy growing at a pace of 0.5% in 2023, and it does not forecast a recession.

“We’ll have one because the Fed is trying to create one,” said Swonk. “When you say growth is going to stall out to zero and the unemployment rate is going to rise ... it’s clear the Fed has got a recession in its forecast but they won’t say it.” The central bank forecasts unemployment could rise next year to 4.6% from its current 3.7%.

Fed reversal?

How long policymakers will be able to hold interest rates at high levels is unclear. Traders in the futures market expect the Fed to start cutting rates by the end of 2023. In its own forecast, the central bank shows rate cuts starting in 2024.

Swonk believes the Fed will have to backtrack on higher rates at some point because of the recession, but Simons expects a recession could run through the end of 2024 in a period of high rates.

“The market clearly thinks the Fed is going to reverse course on rates as things turn down,” said Simons. “What isn’t appreciated is the Fed needs this in order to keep their long-term credibility on inflation.”

The last two recessions came after shocks. The recession in 2008 started in the financial system, and the pending recession will be nothing like that, Simons said.

“It became basically impossible to borrow money even though interest rates were low, the flow of credit slowed down a lot. Mortgage markets were broken. Financial markets suffered because of the contagion of derivatives,” said Simons. “It was financially generated. It wasn’t so much the Fed tightening policy by raising interest rates, but the market shut down because of a lack of liquidity and trust. I don’t think we have that now.”

That recession was longer than it seemed in retrospect, Swonk said. “It started in January 2008. ... It was like a year and a half,” she said. “We had a year where you didn’t realize you were in it, but technically you were. ...The pandemic recession was two months long, March, April 2020. That’s it.”

While the potential for recession has been on the horizon for awhile, the Fed has so far failed to really slow employment and cool the economy through the labor market. But layoff announcements are mounting, and some economists see the potential for declines in employment next year.

“At the start of the year, we were getting 600,000 [new jobs] a month, and now we are getting about maybe 250,000,” Zandi said. “I think we’ll see 100,000 and then next year it will basically go to zero. ... That’s not enough to cause a recession but enough to cool the labor market.” He said there could be declines in employment next year.

“The irony here is that everybody is expecting a recession,” he said. That could change their behavior, the economy could cool and the Fed would not have to tighten so much as to choke the economy, he said.

“Debt-service burdens have never been lower, households have a boatload of cash, corporates have good balance sheets, profit margins rolled over, but they’re close to record highs,” Zandi said. “The banking system has never been as well capitalized or as liquid. Every state has a rainy day fund. The housing market is underbuilt. It is usually overbuilt going into a recession. ...The foundations of the economy look strong.”

But Swonk said policymakers are not going to give up on the inflation fight until it believes it is winning. “Seeing this hawkish Fed, it’s harder to argue for a soft landing, and I think that’s because the better things are, the more hawkish they have to be. It means a more active Fed,” she said.