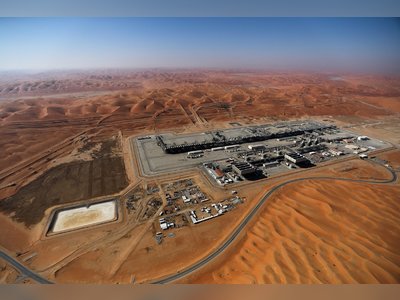

Saudi Arabia Slashes December Oil Prices to Asia Amid OPEC+ Output Rise

Saudi Arabia has significantly cut its official selling prices (OSPs) for crude exports to Asia in December, signalling a strategic move to defend market share amid rising global supply. State-oil giant Saudi Aramco set the premium for its flagship Arab Light crude at US$1.00 per barrel above the Oman/Dubai benchmark, down US$1.20 from the November level.

The company also trimmed premiums for other grades: Arab Medium and Arab Heavy each saw reductions of US$1.40, bringing premiums to US$0.05 and US$0.10 per barrel respectively, while Arab Extra Light fell US$1.20 to US$1.30 per barrel.

The timing aligns with the OPEC+ alliance’s decision to raise output by 137,000 barrels per day for December and delay further increases into the first quarter of 2026. The producer group has now raised targets by about 2.9 million barrels per day since April, amplifying concerns of a supply overhang.

Industry participants view the price adjustment as a calculated response: Asia remains the region’s largest seaborne crude market, and the competitive premium signals Saudi Arabia’s readiness to maintain export volumes even as demand prospects remain uneven. The reduced premium also offers Asian refiners a more compelling feedstock opportunity amid margin pressures.

Traders now will closely monitor whether Saudi term nominations and spot sales rise in response to the lower premiums—especially in China, India, Japan and South Korea. Observers suggest the cuts mark a shift from purely supply restraint to strategic pricing engagement.

While the decision falls broadly within market expectations, it nonetheless reflects a proactive approach by Saudi Arabia to recalibrate its pricing in readiness for evolving demand dynamics. The move also underscores the kingdom’s role in shaping Gulf crude benchmarks across the region.