Saudi Arabia Cuts December Oil Prices for Asia as OPEC+ Moderates Output Hikes

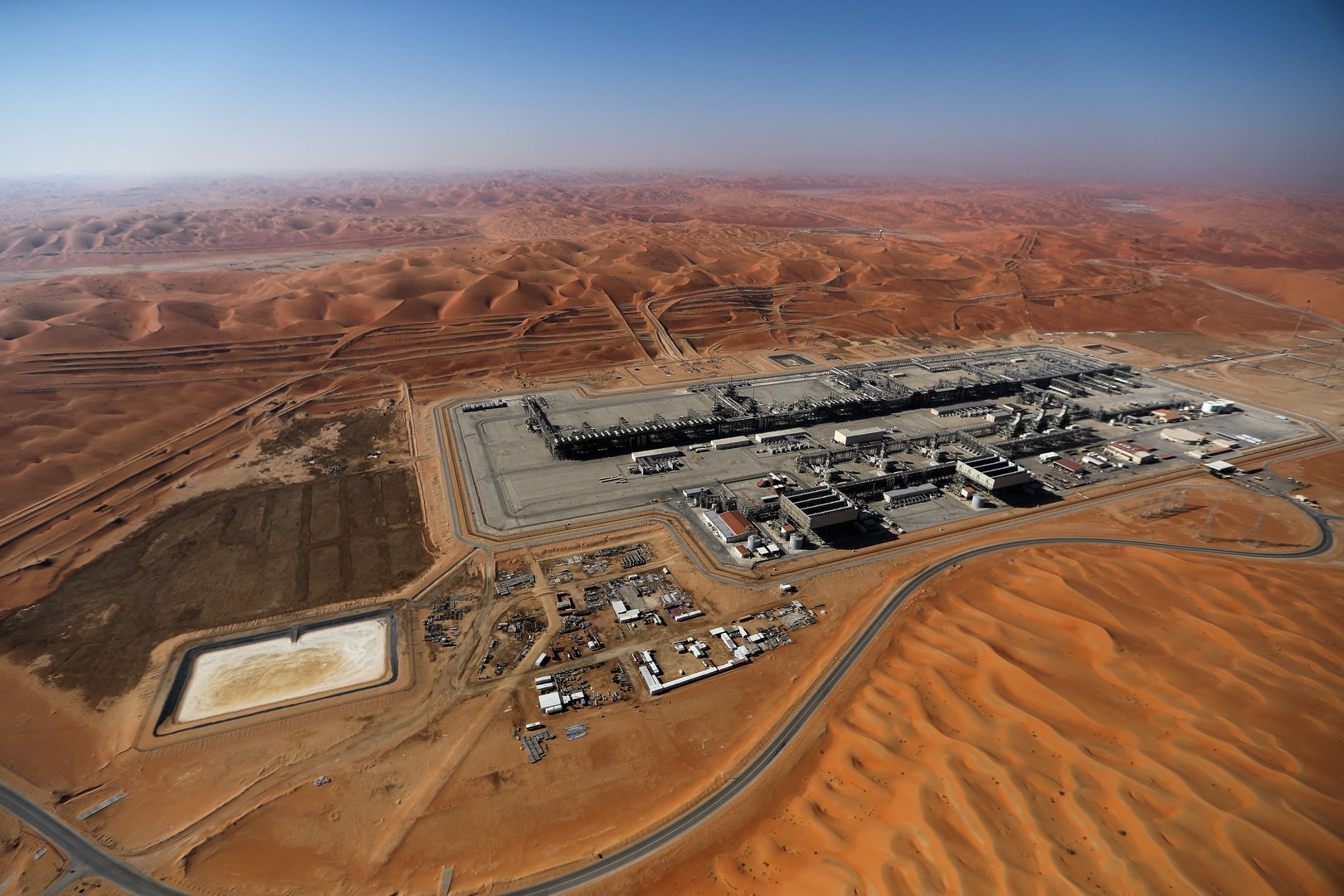

Saudi Arabia, the world’s leading oil exporter, has sharply reduced its official selling prices (OSPs) for December crude shipments to Asia, signaling a strategic effort to defend market share as global supplies expand. The decision follows the recent OPEC+ agreement to raise production modestly in December before pausing additional output increases through the first quarter of 2026.

State energy company Saudi Aramco set the premium for its flagship Arab Light crude at US$1.00 per barrel above the Oman/Dubai average, down by US$1.20 from November. Prices for other key grades also saw notable reductions: Arab Medium and Arab Heavy both fell by US$1.40, reaching premiums of US$0.05 and US$0.10 per barrel respectively. Arab Extra Light and Arab Super Light were reduced by US$1.20, now standing at US$1.30 and US$2.35 per barrel.

The move marks the first price cut since October and comes amid indications that Asian refiners are facing a well-supplied market. The OPEC+ alliance, which includes Russia and other major producers, has increased total output targets by about 2.9 million barrels per day—roughly 2.7 percent of global supply—since April. However, rising inventories and moderate demand growth have led the group to ease the pace of its production recovery.

For Saudi Arabia, Asia remains its most important export market, accounting for the bulk of its long-term crude sales. By trimming prices, Riyadh aims to reinforce competitiveness with rival suppliers such as Russia and the United States, which have expanded exports to the region. Analysts view the decision as pragmatic, balancing market share with price stability.

Prices for Saudi oil destined for the United States were also reduced by US$0.50 across all grades, while prices to Northwest Europe and the Mediterranean remained unchanged. Industry observers expect the pricing adjustments to support term demand from Asian refiners in December, potentially stimulating spot sales as regional margins tighten.

The revisions underscore Saudi Aramco’s adaptive pricing strategy, which integrates feedback from clients and ongoing market assessments to navigate shifts in global supply and demand. Despite the cuts, the company maintains a premium over benchmark grades, reflecting confidence in the long-term strength of Gulf crude in Asia’s refining mix.