'Historic' G7 deal to stop global corporate tax avoidance welcomed by tech giants Google and Facebook

Google and Facebook have welcomed a G7 deal on tackling corporate tax avoidance by big tech companies.

The agreement will see a global minimum corporate tax of at least 15% - lower than a floor of 21% mooted by President Biden - and changes to which countries will benefit.

Chancellor Rishi Sunak called the deal "a proud moment".

Speaking after two days of talks in London, he added it "meant the right companies pay the right tax in the right places".

The changes would ensure major corporations, especially those with a strong online presence, will pay taxes in the countries where they operate and not only where they have headquarters.

Rich nations have struggled for years to agree a way to raise more revenue from large multinationals such as Google, Amazon and Facebook, which often book profits in jurisdictions where they pay little or no tax.

After the announcement Nick Clegg, vice president of global affairs at Facebook said: "We want the international tax reform process to succeed and recognize this could mean Facebook paying more tax, and in different places."

A Google spokesperson said the company strongly supports the initiative and hoped for a "balanced and durable" agreement.

Sky's economics and data editor Ed Conway said: "This is about trying to prevent billions of dollars, if not trillions, of tax avoidance by the world's biggest companies.

"At the moment taxes are mostly based on profit but you can shift those profits far more easily than you can your sales".

Companies with a profit margin over 10% would have a portion of tax taken above that level, which is then reallocated on the basis of sales to different countries around the world.

"That is equally, if not more of a big deal, than the global minimum," Conway added.

"Put those two things together and you have perhaps the most convincing attempt at trying to deal internationally with what's going on with the tech giants and their tax payments.

"The work to try and get this done has been going on for some years, if not decades.

"On the other hand it's easy to be sceptical and the rate - 15% - is a lot lower than it was originally expected to be. It was originally going to be 21%, so the target is less ambitious."

A Treasury spokeswoman explained that the most profitable multinationals would have to pay tax in the countries where they operate and not just where their headquarters are.

"The fairer system will mean the UK will raise more tax revenue from large multinationals and help pay for public services here in the UK," she said.

Mr Sunak said there had been "huge progress" on an issue that had been discussed for nearly a decade.

The agreement is now set to be looked over in more detail at the G20 financial ministers and Central Bank governors meeting in July.

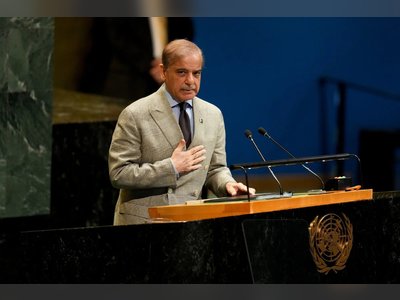

Chancellor Rishi Sunak at a meeting of finance ministers from across the G7 nations

Chancellor Rishi Sunak at a meeting of finance ministers from across the G7 nations

The deal is likely to cause tensions with Ireland, as it has so far been unwilling to raise its corporation tax rate above 12.5%.

Ireland's finance minister Paschal Donohoe tweeted: "I note the joint position by #G7 finance ministers on international corporate taxation. It is in everyone's interest to achieve a sustainable, ambitious and equitable agreement on the international tax architecture.

"I look forward now to engaging in the discussions at @OECD. There are 139 countries at the table, and any agreement will have to meet the needs of small and large countries, developed and developing."

Meanwhile, Labour called on the government to push for more than the 15% base rate, after US President Joe Biden had initially wanted a 21% minimum, which the party said would raise £131m for public services.

"This government must now show leadership, push for a 21% rate in negotiations, and use the money to fund our schools and our NHS," said shadow chancellor Rachel Reeves.

The Adam Smith Institute - a pro-free market think tank - said the chancellor had effectively tied his own hands while handing "power over our taxes to Washington's demands".

"These proposals are not in the UK's interest and Rishi has sold Britain short," said deputy director Matt Kilcoyne.

"Rishi Sunak's flagship policies of super deductions and free ports are dead in the water. The chancellor's own policies, scuppered by his own hubris."