Saudi Arabia’s financial wealth grows to $1 trillion despite challenges from the pandemic

The report, titled ‘Global Wealth 2021: When Clients Take the Lead’, reveals that despite the pandemic’s enduring financial impact, global prosperity and wealth grew significantly throughout the crisis and are likely to continue to expand significantly over the next five years, in line with the emerging economic recovery.

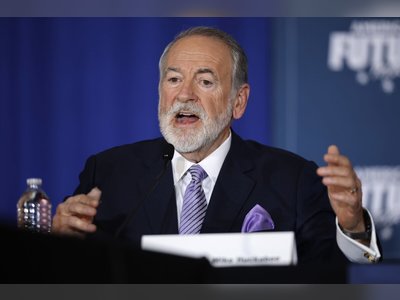

“Saudi Arabia’s growth of wealth has proven to be robust, springing back from challenges presented by the COVID-19 pandemic. The Kingdom’s Vision 2030 has been a driving force to increasing economic productivity, which also is allowing Saudis to participate in an ever-more-global economy which has enabled growth in wealth despite the many economic disruptions that have occurred in recent times,” said Mustafa Bosca, managing director and partner at BCG.

KSA, which represented 45% of the Gulf Cooperation Council’s (GCC) financial wealth in 2020, is expected to witness strong growth of 4.2% CAGR to reach $1.2 trillion by 2025, a $200 billion increase from 2020. Meanwhile, the region’s financial wealth is forecast to reach $2.7 trillion in 2025 from $2.2 trillion in 2020.

A spotlight on onshore asset allocation shows that currency and deposits (44%) accounted for the largest proportion of assets in 2020. Looking ahead, the allocation of onshore assets is set to change slightly by 2025, with equities and investment funds expected to take the larger share of onshore assets amounting to 45% of the overall onshore asset class in the Kingdom.

BCG’s report also shows KSA’s changing landscape of the wealthy in the coming years, with the rise of the next-generation affluent and high-net-worth clients. These individuals, between 20 and 50 years of age, have longer investment horizons, a greater appetite for risk, and often a desire to use their wealth to create positive societal impact as well as earn solid returns. Many wealth managers are not yet ready to serve these new clients.

“Greater economic attainment has enlarged the ranks of the Kingdom’s wealthy. Today there is more wealth in more hands, and as the demographics of wealth shift, so will the needs and expectations of clients. Local wealth managers will have to tailor their offerings more to either local needs or younger wealth segments.” concluded Bosca.To win the new segment of the next-generation segment, wealth managers must bring a bold and new digital business model to life. The five pillars of the new digital model include:

• Supercharged Relationship Management: All of the legwork is done with the use of technology and relationship management to become the key support in the digital conversion funnel

• Contextual and Consumable Learning: Streamlined, gamified, 100% digital content, placed strategically to nudge conversion

• Smarter User And Experience Design: Simple to use platforms, enriched with tools and simulators that clients can play with

• Simplified Pricing: Hybrid model combining asset-based pricing with flat subscription fees

• Democratized Access To "Haute" Investments: Customizable discretionary mandates, and scale-down of (U)HNWI products.